Mergers and acquisitions (M&A) are often seen as reflections of confidence in an economy. Globally, 2024 saw only a modest 10% rise in deal activity. Yet India stood out with a striking 66% surge. From family businesses choosing external buyers over heirs to global investors shifting away from China, India’s M&A story is not just about numbers – it’s about resilience, opportunity, and transformation.

The momentum shows no sign of slowing. Instead, it’s reshaping how industries consolidate, how capital flows, and how leadership transitions are managed.

India’s M&A Acceleration: The Key Drivers

- Business Successors Stepping Back:

- Many second-generation heirs are no longer taking over family-run businesses.

- Instead, companies are entering acquisition markets, creating opportunities for both domestic and global players.

- This generational shift is accelerating strategic buyouts, particularly in traditional sectors like retail and consumer goods.

- Economic Resilience and Growth Outlook:

- India’s GDP grew at 6.5% in 2024 – well above most global peers.

- With the $10 trillion economy vision, large acquisitions are being positioned as long-term bets on consumption and infrastructure growth.

- Economic confidence fuels cross-border interest, making India a preferred M&A destination.

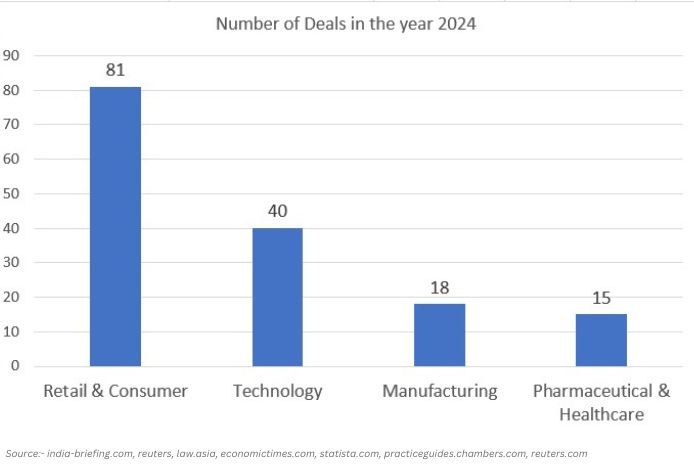

- Sectoral Consolidation:

- Industries like Retail & Consumer (81 deals) and Technology (40 deals) led the transaction charts.

- Media & Entertainment recorded $4.7B across 29 deals.

- Consolidation is not just about scale – it’s about adapting to digital disruption and rising competition.

- Regulatory Support and Capital Availability:

- Liberalized M&A policies simplify cross-border acquisitions.

- $940 billion in private equity dry powder (McKinsey) ensures liquidity for mega-deals.

- India’s regulatory stability continues to attract multinational bidders.

- Digital Transformation Driving Acquisitions:

- Over 100 unicorns make India a tech hotspot for global buyers.

- Digital-first businesses are magnets for acquirers seeking scale and innovation.

- This trend makes technology-driven M&A a structural shift rather than a temporary surge.

- Private Equity and Venture Capital Backing:

- PE/VC investments crossed $50 billion in 2024.

- Funds are not only seeding startups but also scaling acquisitions across tech, fintech, and healthcare.

- With record capital inflows, India remains on the radar of global funds expanding portfolios.

- Foreign Direct Investment (FDI) Confidence:

- Cumulative FDI inflows since April 2000 crossed $1 trillion.

- Foreign capital flows are particularly strong in technology, infrastructure, and financial services.

- This reinforces India’s position as a long-term growth story for international investors.

- Shift Away from China:

- India’s M&A deals touched $7.2B in February 2025, the highest in three years.

- In contrast, China’s M&A fell to 702 deals worth $62.3B in 2023.

- Policy stability, demographic strength, and resilient demand are making India the alternative growth hub.

What This Means for the Future

India’s M&A wave isn’t just cyclical – it’s structural. Generational change, digital adoption, foreign confidence, and capital surpluses are converging to make India one of the world’s most active deal markets.

- For Businesses: Acquisitions are becoming the fastest path to scale.

- For Investors: India is proving to be a high-growth, high-return market compared to peers.

- For Leaders: The question is no longer if M&A is a growth strategy – it’s how fast you’re ready to execute.

India’s M&A momentum signals more than transactions – it reflects a shift in how growth will be achieved in the coming decade. Companies that adapt quickly, investors who back bold bets, and leaders who treat M&A as a strategic lever rather than a backup plan will define the next phase of India’s economic story. The landscape is no longer about survival – it’s about seizing scale before the competition does.